19+ paycheck calculator kentucky

Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. 19 paycheck calculator kentucky Senin 31 Oktober 2022 Edit.

Eastern Kentucky University Admissions Viewbook By Eastern Kentucky University Issuu

Discover a wealth of knowledge to help you tackle payroll HR and benefits and compliance.

. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Kentucky residents only. Our calculator has recently been updated to include both the latest Federal Tax. Free Kentucky Payroll Tax Calculator and KY Tax Rates.

The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Kentucky State. Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. Mississippi Paycheck Calculator also allows you to determine your pre-tax earnings overtime wages and total earnings if you are a tipped employee.

This free easy to use payroll calculator will calculate your take home pay. This income tax calculator can help estimate your average income. Kentucky Salary Paycheck Calculator.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. On the other hand if you make more than 200000 annually you will pay. Supports hourly salary income and multiple pay frequencies.

It is not a substitute for the advice. Use our easy payroll tax calculator to quickly run payroll in Kentucky or look up 2022 state tax rates. Simply enter their federal and state W-4 information as.

The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. Use our easy payroll tax calculator to quickly run payroll in Kentucky or look up 2022 state tax rates.

So the tax year 2022 will start from July 01 2021 to June 30 2022. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. COVID-19 Employer Toolkit Diversity Equity and Inclusion Toolkit.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky.

Kentucky Hourly Paycheck Calculator Gusto

Liberty Manor Apartments 240 Butcher Street Liberty Ky Rentcafe

Pdf Welfare Reform Stacy Deck Academia Edu

The Kentucky Pharmacist Vol 11 No 2 By Kentucky Pharmacists Association Issuu

G608296 Jpg

Commercial Farm Land For Sale In Retreat Pen Browns Town St Ann Jamaica Propertyadsja Com

New Tax Law Take Home Pay Calculator For 75 000 Salary

Pdf Consumption Of Non Nutritive Sweeteners By Pre Schoolers Of The Food And Environment Chilean Cohort Fechic Before The Implementation Of The Chilean Food Labelling And Advertising Law

Accepted Students Next Steps Georgia State Admissions

Top Abacus Classes In Yelahanka New Town Best Mental Maths Classes Bangalore Justdial

2022 Kentucky Derby Post Positions Placement Winners History More

Flats In Sundarpur Bhubaneswar 50 Apartments Flats For Sale In Sundarpur Bhubaneswar

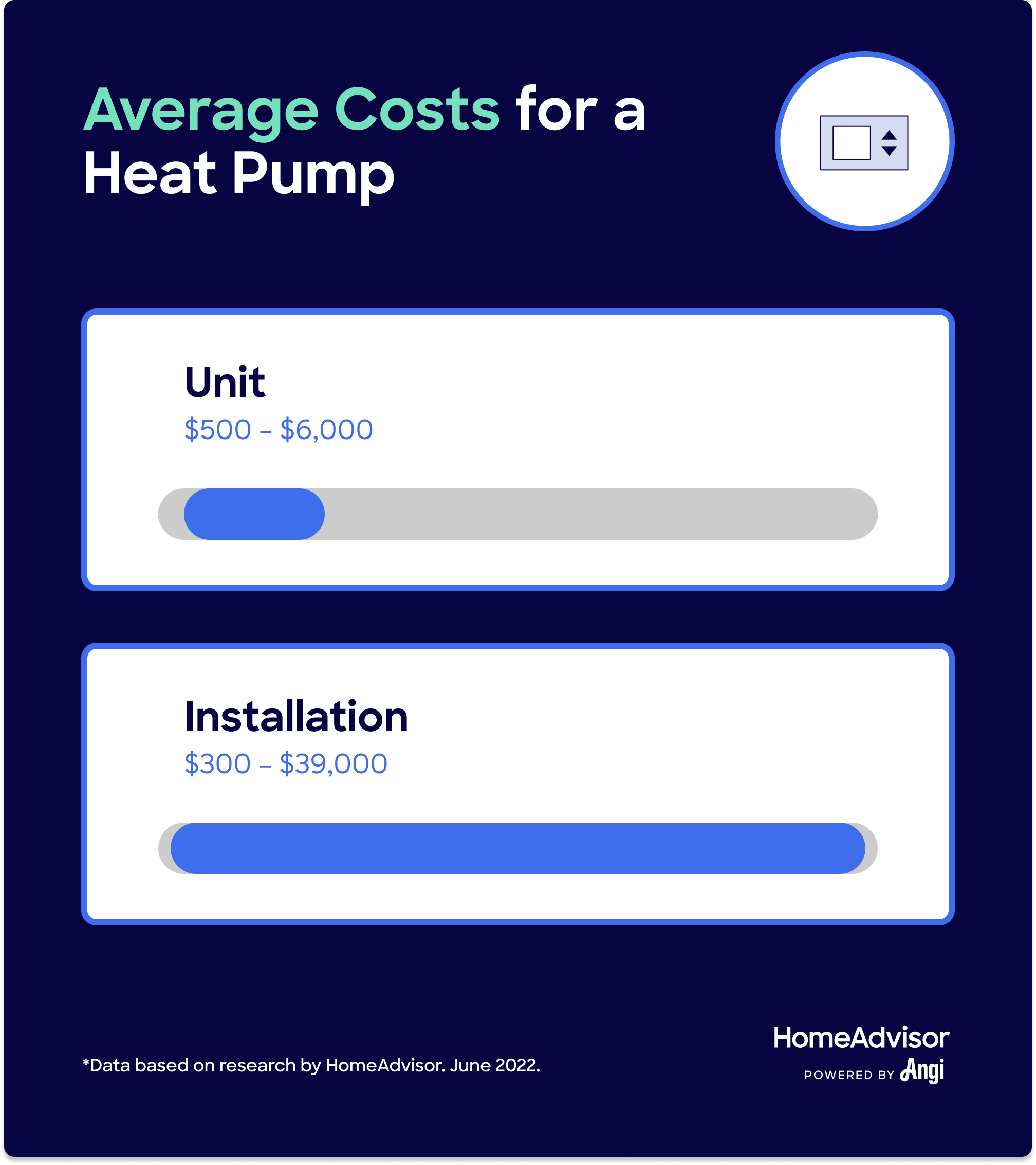

How Much Does A Heat Pump Cost To Install

New Tax Law Take Home Pay Calculator For 75 000 Salary

Salary Paycheck Calculator Calculate Net Income Adp

Us Vs Uk Doctors Salary Detailed Comparison Revising Rubies

Payrollguru Ios Payroll Applications And Free Paycheck Calculators